Notes on Notes - A Money Montage

Heads and Tales

Money problems again.

FACELESS BIGWIGS WHO TRAMPLE ON OUR PRIDE: The European Central Bank’s decision to ban the Queen’s head from euro notes is a huge own goal. At a stroke, a small bunch of unelected bankers have shown they will trample arrogantly over a nation’s pride and heritage without a thought.

Queen’s head banned from euro notes: THE QUEEN’S portrait will not appear on euro banknotes if Britain ever joins the single currency. The European Central Bank has overruled an informal decision that the notes should have space for a ‘national feature’ such as the Sovereign’s head, claiming that it would be inconvenient, confusing and make forgery easier. ... Mr Hague said: ‘The Queen on our currency is a powerful symbol. It is a symbol of our independence and ability to make decisions in our national interest. There remains a real risk that along with this symbol we would lose our ability not only to set our own interest rates, but also the freedom to make our own tax and spending decisions.’ John Redwood, the Shadow Trade Secretary, said: ‘It illustrates that all the fine words about national identities remaining undiluted under a single currency were just for the birds.’ He also pointed to a pre-election article in which Tony Blair had written: ‘I know exactly what the British people feel when they see the Queen’s head on a £10 note. I feel it too. There’s a very strong emotional tie.’ Mr Redwood said: ‘Apparently his love for the pound was only election-deep. Tony Blair must act immediately to get this decision reversed.’

The father of political economy, William Petty might have had a few retorts to this fixation on the image, this love of surface, rather than the thing itself. His concern, in ‘Quantumlumcunque concerning money’ (1682) was only that money be equal to itself – ‘Because all must be like...’, and so it must be re-minted, made of equal weight. That is to say, money’s symbolic value, its fine designs and pictures, should not enter the picture. Indeed, he insists, this symbolism must not enter the picture, for he notes a large problem of hoarding on the part of those who become too attached to the image of their money, and desire not to exchange it. The aesthetic value of money might exceed its exchange value: ‘...bad and unequal Money may prevent hoarding, whereas weighty, fine, and beautiful Money doth encourage it in some few timorous persons.’ In 1672 it had been the case that the attractive new milled coinage with the image of Britannia tended to disappear from circulation, though not as quickly as new silver coins do. Existing worn, unattractive hammered coins and tokens continue to circulate, thus leading to a debasement of the state of money itself.

Suppose that 20s of new mill’d Money doth weigh 4 Onces Troy, according to Custom or Statute. Suppose that 20s of old Eliz. and James’s Money, which ought also to weigh four Onces Troy, doth weigh Three Onces Troy; and vary variously between 3 and 4 Onces, viz. none under 3, and none full 4. Suppose that much of the new mill’d regular Money is carried into the East Indies, but none of the old light and unequal Money.

And so Petty sets off awareness of money’s existence as the thing exchanged, rather than a symbol of it, rebuking those ‘few such fools as take money by its name, and not by its weight and fineness’. Money must not be loved for its images, its symbols, but for it solidity, reliability, its setting of standards. Coins cause many of the problems – the small coins get lost and wear away, the metal slipping through the fingers, chipping or wearing down. Money becomes less than equal to itself. As Marx puts it later in Capital, vol. 1, describing the coin’s journey to the ‘melting-pot’:

During their currency, coins wear away, some more, others less. Name and substance, nominal weight and real weight, begin their process of separation. Coins of the same denomination become different in value, because they are different in weight. The weight of gold fixed upon as the standard of process, deviates from the weight that serves as the circulating medium, and the latter thereby ceases any longer to be a real equivalent of the commodities whose prices it realises. The history of coinage during the middle ages and down into the 18th century records the ever-renewed confusion arising from this cause.

Circulation, notes Marx, has a natural tendency to convert coins into a mere semblance of what they profess to be, into a symbol: ‘Goldsein’ becomes ‘Goldschein’.

Paperbank Writer

William Petty’s urgent notes on money and its unequalness to itself were a part of his campaign for a Bank of England. In France, the Paris Mint was fully mechanized in 1645 and had started the production of milled coins. Such edges made clipping and cutting and counterfeiting quite blatant, and so the milling was an attempt to entwine the nominal and the real in some way. But in England around 1660 goldsmith’s receipts had turned effectively into banknotes. Things were moving in the world of money. Coins’ tendency to wear away suggests the possibility of a fully symbolic material. It underlines a separation of value, metallic value, monetary value and weight. Perhaps banknotes would settle the problems of money’s potential non-identity to itself, by making the medium itself quite fully symbolic, actual discrepancies of the symbolic could be rendered insignificant.

Paper money, which had been around since seventh century China, only became more widespread in Europe in the seventeenth century. In 1694 the Bank of England was founded – its pressing concern to procure funds for the war of the League of Augsburg by taxation and a permanent loan. A desperate financial situation had arisen and the issue of a £1 000 000 lottery loan with large cash prizes for winners had been one scheme that prefigured the birth of the bank. The bank instituted and without delay commenced the issue of notes in return for deposits. Each ‘running cash note’ issued carried the corporate emblem: Britannia seated gazing at a bank of gold coin. These large sheets of paper – handwritten, black and white and one-sided – could be redeemed for gold or coinage by any person who tendered them. The paper notes could be made to stand for any amount, and were redeemable only by the person named on them. They were an acknowledgement of deposit of coin. By 1698 under half of England’s money supply was coin – and coin that there was under Newton’s mastery of the mint, from 1699 to 1727, did turn from silver into gold. Newton was behind the re-coinage of the 1690s and expended much time and effort pursuing counterfeiters. But a more significant, less alchemical move – or a move that was alchemical in different ways – was underway. Money was turning into paper. A contemporary writer by the name of Davenant conjectured that the value of all the coins in circulation amounted to less than that of bills, tallies and banknotes. Paper can be transmuted more easily than lead can change to gold. It transmutes into gold still locked in the ground. It bears the signature of authority. The alchemists – employed, for example, by the Duc d’Orleans in the hope they would produce gold from cheaper materials – fall out of favour when paper money becomes perceived as a more effective way to redeem debts. The Scottish financier John Law had arrived at the court promulgating his paper money schemes. That paper – so banal a material – could be an exchange for gold, transmuted into gold, that is, was a fantastic gimmick, and worthy of alchemical acclaim. Law advocated issuing unbacked paper money. He established the ‘Banque Generale’ in 1716 to help out in financing the bankrupt French court after the death of Louis XIV who had run up vast debts from endless warring and lavish palace outfitting. Law persuaded Orleans to allow the Mississippi Company to be formed. This would assume the French Crown’s debt in exchange for a charter to operate Louisiana as a colony. Shareholders provided the money to back the Crown’s debt and currency, and they would reap dividends on the profits to be made in Louisiana. Frenzied speculation took off. The note-issuing bank was a sensational success – until it was clear that no dividend bonanza was forthcoming. The ‘Mississippi Bubble’ burst after a bank run in 1720, driving France and Europe into deep economic crisis. Law decamped from France just ahead of a murderous mob who were furious at being swindled through the paper money scheme.

By 1725 printed denomination notes came into existence, though it was not until the middle of the next century that the first fully printed notes appeared, and released the cashier from the personal touch of furnishing the bearer’s name and signing every single note. Mass reproduction had set in. Far from being tokenistic, notes had proved durable – for they had survived a tremendous crisis in 1797 when the long years of war with France so drained gold reserves that the bank suspended the convertibility of note to coin. Moneymen found out then that the bank’s credit did not depend on convertibility of notes into gold, but on the more illusive factor of confidence. If confidence in the bank was maintained, then business could occur, conducted on a foundation of inconvertible paper money. ‘Payable on demand’ became the lie that underpinned actuality

This shift to notes might have knock-on effects in epistemology, or at least in the metaphors used. That notions of truth were shifting along with the coinage’s vaporizing into symbol is evidenced in Hegel’s preface to his Phenomenology of Spirit (1807). Lockean sense perception, with its dull empiricism, its mind-embossing objectivism, is mocked by the master of historically and dialectically determined knowledge:

‘True’ and ‘false’ belong among those determinate notions which are held to be inert and wholly separate essences, one here and one there, each standing fixed and isolated from the other, with which it has nothing in common. Against this view it must be maintained that truth is not a minted coin that can be given and pocketed ready-made.

His jibe is surely conscious of Locke’s recommendation in ‘Further Considerations Concerning Raising the Value of Money’ [1695] to counter the age-old royal debasement of the unit of money: ‘the unit was and should be a definite weight of bullion, which must not be altered.’ Locke had access to Newton’s ear, and in the following year Newton was made the Warden of the Royal Mint and in 1699 its Master. In the 1690s he undertook the recoinage and nothing concerned him as much as nailing counterfeiters. Hegel, on the other hand, has a rather more complicated view of true and false. Truth was historical and maybe then more flexible, like the note that has worked free of its metallic equal, invading the realm of the symbolic. Hegel’s emphasis shifts to the concept of illusory being or semblance, in German, Schein, which is also the word for banknote. This introduces a negative dialectical moment.

All that glitters is not gold

Money’s symbolic excess slips into Marx’s delineation of money’s powers. The human personality is formed through the magic of money: ugliness is turned into beauty, base becomes noble, old made young. It changes fidelity into infidelity, love into hate, hate into love, virtue into vice, vice into virtue, servant into master, stupidity into intelligence and intelligence into stupidity. But through all this wild activity of transformation it is not men and women but money itself that experiences all this – money eats, it drinks, it goes dancing and to the theatre, it appropriates art and political power. It can buy everything. It can do all of that, but really, left to its own devices, money just likes to reproduce itself, it likes to buy itself. And money as capital transforms money itself, making it at least seem to be an all-powerful self-expanding entity.

Capital appears as a mysterious and self-creating source of interest – the source of its own increase. The thing (money, commodity, value) is now capital even as mere thing, and capital appears as a mere thing. The result of the entire process of production appears as a property inherent in the thing itself.

Marx cites Goethe’s Faust for its poetic push: ‘money is now pregnant’ – ‘Geld hat Lieb’ im Leib’. Money begets money, so it would seem, when it turns into interest-bearing capital. And in the ‘Economic and Philosophical Manuscripts’ of 1844, he reflects on a passage in Faust part I in order to explicate the nature of money. Marx quotes Mephistopheles:

What, man! Confound it, hands and feet

And head and backside, all are yours!

And what we take while life is sweet,

Is that to be declared not ours?

Six stallions, say, I can afford,

Is not their strength my property?

I tear along, a sporting lord,

As if their legs belonged to me.

Marx analyses the passage:

That which exists for me through the medium of money, that which I can pay for, i.e. which money can buy, that am I, the possessor of the money. The stronger the power of my money, the stronger am I. The properties of money are my, the possessor’s properties and essential powers. Therefore what I am, and what I can do is by no means determined by my individuality.

Marx could have looked to Faust part II, for here is the devil’s accomplice attempt to prove that wealth is endless, just not seen. The tale is one that involves money’s power to bestow omnipotence upon the individual. At least that is the promise:

Mephistopheles: Where in the world is something not in short supply? Someone lacks this, another that, but here the lack is money.

Of course you can’t just pick it off the floor

but wisdom’s skill is getting what’s most deeply hidden.

In mountain’s veins and in foundation walls

you’ll find both coined and uncoined gold,

and if you ask who will extract it, I reply:

a man that nature has endowed with mighty intellect. (l. 4889ff)

Herewith Mephistopheles begins his plan to convert the clapped out imperial land where he and Faust are guests from gold currency to a paper-money based system. Once this is done they will be able to develop productive forces in the coastal area, mobilizing the workforce and exploiting them massively. The paper money plan will give them real power. (Goethe knew his stuff. In the autumn of 1775 he had left Frankfurt to visit Weimar at the invitation of the young duke Karl August. He became the duke’s close personal friend and organised court theatricals. In 1776 he was given rights of citizenship and assigned administrative responsibilities in the tiny duchy. These included financial affairs, and building works.) Mephistopheles’s solution is so simple. He convinces the emperor of the validity of the plan purely by evoking the phantom of all the wealth that may be hidden in nature’s core. So surely a promissory note can be made for the value of such gold, this natural resource. The world itself is turned into the quintessence of money. Mephistopheles promises indefinite growth. There is no limit that can be reached. The fluid of exchange is all, the material that backs it is nothing but a fantasy. The terms reverse. Money is fetishised. The basis of the empire will shift from the solidity of metallic gold to insubstantial promises on paper. Wealth lies dormant, and the production power of labour is disregarded as part of the valorization process. His case is won, as is revealed later in the Emperor’s Garden:

Chancellor: Who, in old age, can be carefree at last. –

Now hear, and see, the fateful document

that has transformed all grief into contentment.

(Reading) ‘To whom it may concern, be by these presents known,

this note is legal tender for one thousand crowns

and is secured by the immense reserves of wealth

safely stored underground in our Imperial States.

It is provided that, as soon as it be raised,

said treasure shall redeem this note.’

Emperor: There’s been some great and criminal fraud, I fear.

Who forged the Emperor’s signature to this?

Does this crime still remain unpunished?

Intendant: Don’t you recall, only last night

you signed your name yourself? You were Great Pan;

the chancellor came up with us to you, and said:

‘Allow yourself the culminating festive pleasure –

salvation for your peoples – with a few strokes of the pen.’

You signed, and then before the night was over

quick conjurors made copies by the thousands.

To guarantee that all may share this blessing,

at the same time we placed your name on a whole series;

thus tens and thirties, fifties, hundreds too are ready.

You can’t imagine how this pleased your subjects.

See how the town, so long half-dead and mildewed,

is full of life and teems with pleasure seekers!

Although your name has long been much beloved,

never before has it been viewed with such affection.

The alphabet is really now superfluous,

for in this sign can all men find salvation. (l. 6054ff)

Mephistopheles reveals how these scraps of paper can buy sex, and they can buy it far quicker than can wit or eloquence. Lethargic wealth hid under the ground has become animate, released by the dynamism of capitalist development. And all know where they stand – for value is stamped on each paper note, making bargaining and haggling redundant. Fixing value, pinning down the symbol, the flighty presence of money, was underway elsewhere. At this same time, the British were devising ways of fixing value internationally through the gold standard. The Gold Standard was adopted in Britain in 1816, linking the pound sterling to a fixed quantity of gold, and it set the terms for British capital’s leadership in international trade, what might be called its Faustian bargain. It was to last until it was blown to smithereens in war, and the symbolic accord shattered, sending money into crisis and crisis into money.

Zero after Zero: Inflationary Tales

The Great War dissolved the Gold Standard. It was abandoned effectively in 1914, as the national debt soared. As the gold standard collapsed, the government recalled gold coinage known as sovereigns and half-sovereigns, and issued new notes. For the first time, the sovereign’s head appeared on British notes. The tangibility of gold is exchanged for the cheap symbolism of the head of state. A partial return to the Gold Standard in 1925 – with convertibility guaranteed for bars of 400 ounces or more – collapsed in the Depression in 1931. Any remaining certitude about the fact that what is stamped on a note means anything fixed in terms of value was overturned with excessive drama in the famous runaway inflation of Germany after the First World War. The inflation began in the war, because the German government launched a borrowing programme, hopeful of swift military victory and favourable repayment conditions. Victory did not come, and defeat came slowly. The government printed more and more notes. Prices doubled in the war years. This quick-fix solution of mass reproducing notes continued after the war. In 1922 a great inflation kicked in. The inflation reached its peak by the late summer of 1923. One-dollar cost 31 700 marks on the 1 May. On the 1 July it cost 160 400 and on the 1 August it was 1 103 000. From then on, every few hours prices doubled. Workers rushed out to spend all their money before it bought only half as much again. Million mark notes were used more usefully as wallpaper. This episode in German history coincided – not coincidentally – with Walter Benjamin’s turn to Marxism. The book that Benjamin wrote as his turn was taking place was One Way Street. One of its key sections was a piece that he had begun during the inflation, called ‘A Tour of German Inflation’. The tract was a cry against the way in which money had taken over, and had become the only theme – a situation that was far worse probably than anything that the money-critic Georg Simmel, who died just before the war’s end, might have imagined were possible.

All close relationships are lit up by an almost intolerable, piercing clarity in which they are scarcely able to survive. For on the one hand, money stands ruinously at the centre of every vital interest, but on the other, this is the very barrier before which almost all relationships halt; so, more and more, in the natural as in the moral sphere, unreflecting trust, calm, and health are disappearing.

But money is not untrue – that is to say this circulating medium really does hook people into actuality. Elsewhere in One Way Street Benjamin makes the comparison between books and harlots – ‘footnotes in one are as banknotes in the stockings of the other’ – that is to say they expose the actuality and objectivity of the exchange. People are joined together by paper chains. These links – more reinforced for some than others – must, notes Benjamin, have an impact on morality. Shame marks the bearing of those who have money, and they hand out tokens in order to both mask their guilt and conceal the sight of inequality:

It is impossible to remain in a large German city, where hunger forces the most wretched to live on the bank notes (Scheinen) with which passers-by seek to cover an exposure that wounds them.

Hyperinflation exacerbates the centrality of money, and as numbers of zeros multiply, life itself seems to become more and more insignificant. ‘Tax Advice’ notes the following connection between money and lived life:

Beyond doubt: a secret connection exists between the measure of goods and the measure of life, which is to say, between money and time. The more trivial the content of a lifetime, the more fragmented, multifarious, and disparate are its moments, while the grand period characterizes a superior existence. Very aptly, Lichtenberg suggests that time whiled away should be seen as made smaller, rather than shorter, and he also observes: ‘a few dozen million minutes make up a life of forty-five years, and something more.’ When a currency is in use a few million units of which are insignificant, life will have to be counted in seconds rather than years, if it is to appear a respectable sum. And it will be frittered away like a bundle of banknotes: Austria cannot break the habit of thinking in florins.

If money is the link between people, then its inflation is of moral import. For Benjamin, money relates to lies. In notes for ‘A Tour of German Inflation’ Benjamin records an extraordinarily swift inflation.

The circulation of bank notes over many years removes the feeling of responsibility from people. The issuing of pretty colourful notes of state money encourages lies. For this nation, a period of just seven years separates the introduction of the calculation with half-pfennigs (by the postal authorities in 1916) from the validity of the ten thousand mark note as the smallest currency unit in use (1923).

The loss of the war separates the two events. Later, in 1933, in the essay ‘Experience and Poverty’, Benjamin draws the inflation into a complex of disappointments that led to his definitive break with Wilhelmine rule and his recognition of the basic illegitimacy of the rule of the bourgeois class. The fundamentally moral-political meaning of inflation is asserted once more. The ruling class is immoral.

For never have experiences been punished more severely by lies, than strategic experience by the lie of the war of position [trench warfare], economic experience by the lie of inflation, corporeal experience by hunger, ethical experience by those with power. A generation that had gone to school in horse-drawn carriages, now stood beneath the heavens in a landscape in which nothing but the clouds had remained unchanged and in the middle, in a powerzone of destructive forces and explosions, was the tiny, fragile human body.

One Way Street, a book to which Benjamin added material over several years, also records a similarly political reading of the significance of inflation, with inflation credited as a portent of the bourgeoisie’s demise. The abolition of the bourgeoisie, Benjamin contends, must be accomplished before an ‘almost calculable’ moment of economic and technical development, signalled by inflation and gas warfare. Inflation is the wake-up call.

Benjamin’s most famous, most reproduced essay, ‘The Work of Art in the Age of Mechanical Reproduction’ (1935- 1939), mentions money in its first thesis:

In principle a work of art has always been reproducible. Man-made artifacts could always be initiated by men. Replicas were made by pupils in practice of their craft, by masters for diffusing their works, and, finally, by third parties in the pursuit of gain. Mechanical reproduction of a work of art, however, represents something new. Historically, it advanced intermittently and in leaps at long intervals, but with accelerated intensity. The Greeks knew only two procedures of technically reproducing works of art: founding and stamping. Bronzes, terra cottas, and coins were the only artworks which they could produce in quantity. All others were unique and could not be mechanically reproduced.

A coin is a coin and so is not unique, and therefore cannot be art. It is the ‘original’ mass reproduced. This was the flip side of an earlier half-mooted project: to consider currency as art. With a keen eye for deciphering the hieroglyphs of mass reproduced culture, Benjamin calls for an analysis of the tokens that pass between people, so often unseen. What might this most visible but seldom seen paperwork reveal about the state of things?

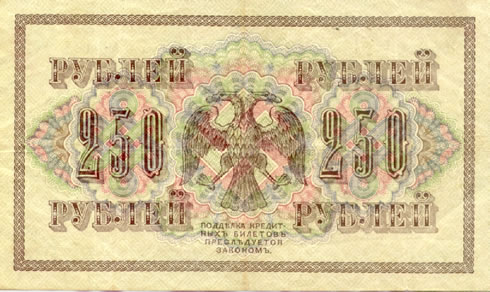

A descriptive analysis of bank notes is needed. The unlimited satirical force of such a book would be equalled only by its objectivity. For nowhere more naively than in these documents does capitalism display itself in solemn earnest. The innocent cupids frolicking about numbers, the goddesses holding tablets of the law, the stalwart heroes sheathing their swords before monetary units, are in a world of their own: ornamenting the facade of hell.

Surely Benjamin is correct. These little works of culture, themselves symbols of wealth, are also symbols of capitalism’s self-image: self-aggrandizing, born to rule in perpetuity, as the backward glance at antiquity should prove. Yet it is also not inconceivable that capitalism might tear up this symbology and start again, in desperate circumstances. Hence Herbert Bayer’s million mark, two million marks and one billion mark notes for the inflationary coffers of the Thuringian State government, designed at the Weimar Bauhaus in 1923. They have no pictorial elements, no cupids and Greek goddesses or sovereigns, but just a blockish, characteristically Bauhaus script and a dominating row of zeros, plus the standard legal refrains. Put into circulation on the 1 September 1923, they were not as serviceable as hoped, for higher denominations were already necessary. Was it the case that a certain antipathy was visible in his non-aggrandizing aesthetic choices? Was too much exposed by the hyper-rationalist money design as legal tender in an irrational system? In any case Bayer’s efforts for capitalism in Weimar did no favours for the Bauhaus. The following February a right-wing government was put in power and it contained members who had long been keen to close down the ‘Bolshevist’ institute. They cut its grant by half, and slowly asphyxiated the Weimar institute to death through money withdrawal.

Money and Power

Benjamin’s experiences in the inflation era came back to him when he visited Moscow in December 1927. ‘State capitalism in Russia’, he notes, ‘retains many of the features of the inflation era’. Any NEPman can, from one day to the next, fall victim to a turnabout in economic policy or to a passing whim of propaganda. Nonetheless colossal fortunes accumulate in the hands of what Benjamin calls the heroes of NEPmanship. Another feature of the inflation era is the ration cards. The limited distribution of limited commodities depends on a coupon system: ‘paper continues to play a major role in business transactions’. And just as previously only seen in the inflation era in Western Europe, the Soviet citizens are oblivious to clothes. Though this is on the turn – in the theatres dress is becoming more formal again, presumably as the revolutionary wave recedes.

According to Benjamin, the curious nature of the situation in the Soviet Union in the late 1920s is expressed precisely in the misalignment between money and power, two forces that are aligned in the West. In the West money buys influence. In the Soviet Union, the party has power, and the NEPmen, the motive forces of the New Economic Policy and its limited return to capitalist economics, have the money. Money and power are dirempt. In the Soviet Union social status is determined by the relationship between an individual and the Party. The Party or the bureaucracy retains the power and the NEPmen have the money. It is a class state still – and alongside that, castes have emerged, but money and ownership of the means of production are not strictly the determinants of influence. Caste status is determined not by clothes but by relationship to the party. The NEPman is often an outcast, because he has money, and so therefore he is distrusted, for his position does not accord with the legitimating narrative of the state. But the NEPman has no power and no status. His money is not a symbol of value, but of pariah status. For the Soviet people, wealth, geniune wealth does not come in the form of money, coins or paper notes, but is human, territorial, and connected to the ability to make decisions. This sense of wealth as activity, engagement, social power is what makes life in Russia so heavy with content, so full of events and prospects. ‘From early till late people dig for power.’ Self-activity, engagement is the watchword. Benjamin comments:

If the European correlation of money and power were to emerge here, the country would not be lost, not even perhaps the Party, but Communism in Russia would be.

Power is returned to the people – with all the contradictions and corruptions – which that involved in a revolution confined to one country. Money becomes fluid there again, but without any meaning for power. This was just one episode in money’s undoing in the twentieth century..

Back West

In 1928 Hans Richter attempted to make artistic and political capital of the madness of the inflation years. He made Inflation, a little b-movie before an UFA feature film called The Lady with Mask. The opening title reveals the film to be ‘a counterpoint of declining people and growing zeros’. It is a montage of inflation scenes cut across by dollar signs and multitudes of zeros whose multiplication signals the shrinking value of the Deutschmark. Commodities flash past, a house, a car, a sewing machine, an ornamented clock, shoes, alcohol, a book, a cigarette, this last one burning up as smoke and ash, and making graphic how temporary commodities and their value is. More and more money buys less and less goods, as prices depreciated by the hour and $1.00 equalled up to billions of marks. Exchange is a dizzying substitution. People stare out from the screen, their heads patterned into the shape of zeroes. In this context, they have become nothings. Exchange is everything – and the people are but reactors to the temporary values of their notes. The human figures exist beneath the superimposed zeros figures of the superinflated banknotes, cramped by the unbroken link of money. Dollars are the new hieroglyphs, their equivalence value unfixed. Inflation is, at the same time, its opposite, depreciation. These zeros link into history again, for they seem to be portents of the devaluation of human life in the mass mobilizations that had been and were to come, ciphers of thousands of men deployed in war, and the millions who would kill each other and be killed.

The same year - 1928 - brought the first coloured notes issued by the Bank of England. They were also the first to be printed on both sides. Notes were becoming more elaborate, though still they held onto that squiggly old-fashioned look. Intricate machine-engraved patterns and a greater pictorial element hoped to beat the counterfeiters. This intricacy was not enough though, as the big 1940s forgery operation based in Sachsenhausen Concentration Camp outside Berlin proved. The concentration camp prisoners successfully faked the Allies’ money, leading to extraordinary panic. Of course, money was always a curious thing inside the camps. Some camps had money, produced by the prisoners, but it was not a payment for work, for the workers were slave-labourers. It was rather a ‘reward’ for good behaviour, something more of a symbol than something real. Currency in the camps was another indication that this rationalizing solution, money, could quite well exist in the most irrational of ‘communities’.

Money: A Major Body of Cash – A Significant Philosophical Discussion

On 22 August 1994, Cauty and Drummond – The K Foundation – travelled to the island of Jura off the West Coast of Scotland with a suitcase containing £1 million in new £50 notes. Two others accompanied them as witnesses to the deed they were about to commit. In the early hours of the next morning in a derelict boathouse Cauty and Drummond set the notes on fire. £1 million burnt to ash in just under an hour. The ashes were swept into a suitcase.

(At a screening of a film of the burning)

Member of Audience: You have destroyed notes with a monetary value of £1 million. These notes represent ... they are a token of the value that people put on them. When you were KLF you were able to ... you are part of this western, northern culture in which we, as members of that society, have far more money at our disposal than those who live in the south or east – the underprivileged parts of the world. If you’d wanted to make a real statement, you’d have taken what you required and returned it to those people from whom it was taken. We have only more because they have less – it’s not possible to have more without your returning it.

Bill Drummond: You still haven’t answered the question: ‘What was that money?’

MOA: I think I have: what you burnt was proceeds which represent the resources that you have burnt.

BD: What resources have we destroyed? What is there less of in the world? Are there fewer loaves of bread or grains of rice in the world because that much paper doesn’t exist anymore?

MOA: The paper circulates; it can spread around people. That million pounds could gather in a pyramid; it spreads to the bottom guy who wants to survive, who wants to pay 25p for a Mars bar. It goes right down to that scale and now that is no longer possible – it has been taken out of the world. That money represented resources and you took it away and destroyed it; and you had no right to destroy it – it’s sheer arrogance to think that you have that right to destroy it.

Jim Cauty: It was our money.

MOA: It’s not your money, it’s society’s money. You had no right to destroy it. None at all.

JC: So what are we supposed to do – buy things with it?

MOA: I agree – it’s not the fact that it was or wasn’t your money – if it’s yours you can do what you want with it. It’s the fact of publicising it – gaining publicity for what you’ve done. It’s wrong. Why not go up to a tramp in the street and say ‘there’s £1 million, you’re now a millionaire.’

MOA: Is it not a criminal offence to burn it?

BD: It’s a criminal offence to tear it, scribble on it; put holes in it; but it isn’t a criminal offence to burn it. They never thought to make a law against it; they never thought people would be that stupid.

They did not burn food – as food producers and their agents do each day in order to keep up prices on the world market. And they did not – National Lottery-like - lift one person out of poverty into millionaire status. Nor did they buy a Mars bar for 400 000 people. Instead, not knowing quite why they did it, they burnt a million pounds, which is tantamount to burning an idea of something. Drummond speaks ruefully of how the £1 000 000 was a magic figure, of psychic significance – and now seems paltry with the multi-million lottery wins. Until the winning of a billion – or the burning of a billion – is conceivable, there cannot be another magic number, another (al)chemical act of transformation – of money into art (was the act the art or was the art in the clumping of the ashes into a brick for exhibition?) This K Foundation act led only to more questions and from them to exasperation and confusion. Marx might have predicted the responses, for from his first political-economic writings he had recognized that money, as the existing and active concept of value, confounds and exchanges everything. It is the universal confusion and transposition of all things; the inverted world, the confusion and transposition of all natural and human qualities. Money’s destruction could only lead to more confusion as it, the bond between people, is immolated, the lines of communication, the threads of what we have come to call understanding or rationality, are devastated too. Marx provides a motto for this incomprehension:

If money is the bond which ties me to human life and society to me, which links me to nature and to man, is money not the bond of all bonds? Can it not bind and loose all bonds? Is it therefore not the universal means of separation? It is the true agent of separation and the true cementing agent, it is the chemical power of society.

Iain Sinclair, confusionist extraordinaire, cut through the confusions of money as art, art as money – with the helpful pointer that art money is ‘no more negotiable than Monopoly money’, and he saw the magic of K Foundation’s pyrotechnical act in its truth:

The truth is that people fear and dislike money. They’re relieved not to be stuck with it, the responsibility, the need to consume, invest, recycle. It’s dirty, it’s ugly. It’s covered with engravings of people you wouldn’t want in your house. Dead people. Royals who are experts in the silent acquisition of all the loose change in the universe. They’re born to it. It doesn’t embarrass them. They’re not fazed by creeping Masonic symbolism. If there’ is a conspiracy, they’re in it. The green stuff is like a family album.

Though demagogic politicians cling to the look of money, the look of yesterday – symbol of a ‘a nation’s pride and heritage’ – the problem is not money’s appearance. It is the thing itself. The problem is money.